Featured

Table of Contents

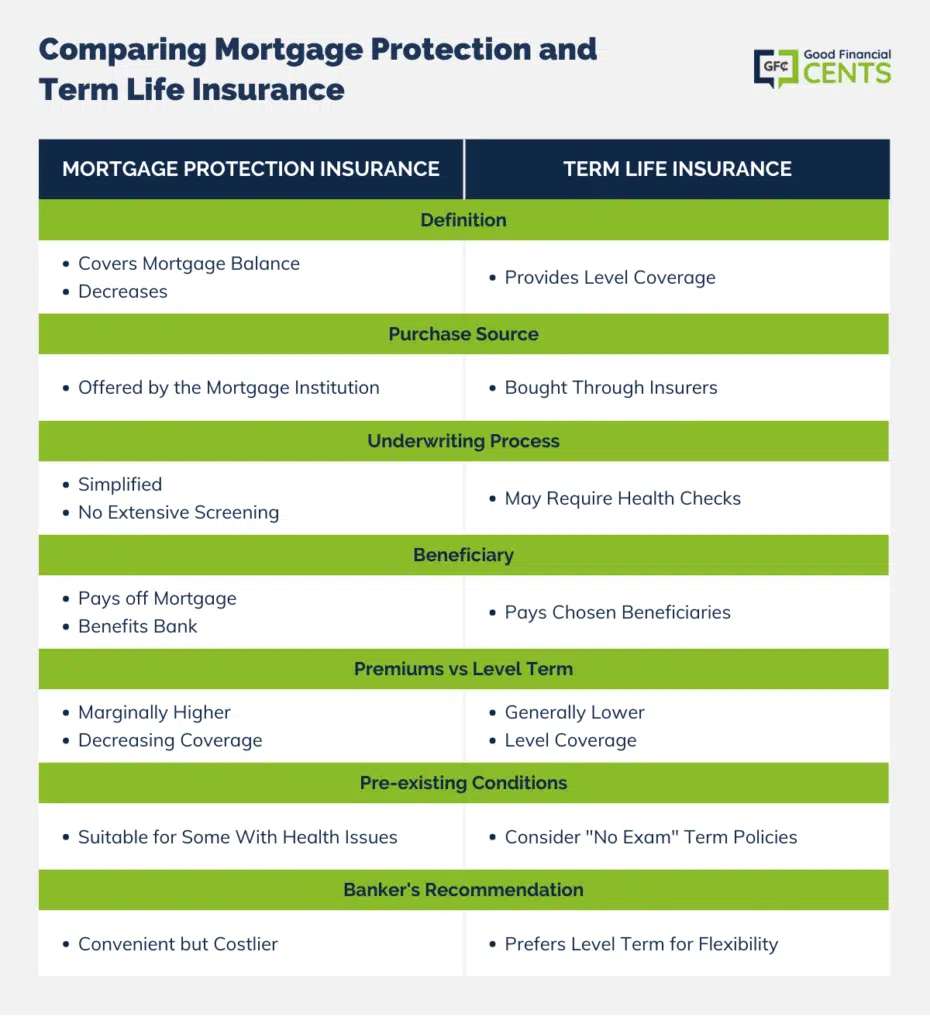

Right here's just how the 2 contrast. The essential difference: MPI insurance coverage pays off the continuing to be equilibrium on your mortgage, whereas life insurance policy provides your beneficiaries a death advantage that can be used for any type of function (mortgage payment protection insurance companies).

Many policies have a maximum limit on the dimension of the home loan equilibrium that can be guaranteed. This optimum amount will be described when you get your Home loan Life Insurance Policy, and will certainly be recorded in your certificate of insurance. But also if your beginning home loan balance is more than the optimum restriction, you can still guarantee it approximately that limitation.

They likewise like the reality that the profits of her mortgage life insurance policy will certainly go straight to pay out the mortgage balance as opposed to possibly being utilized to pay other financial debts. do you need life insurance for mortgage. It is very important to Anne-Sophie that her family members will have the ability to proceed staying in their household home, without economic pressure

Nonetheless, keeping all of these acronyms and insurance coverage kinds directly can be a frustration. The adhering to table positions them side-by-side so you can quickly distinguish among them if you get puzzled. An additional insurance policy coverage type that can settle your home loan if you die is a conventional life insurance coverage policy.

Mortgage Policy

A is in place for an established number of years, such as 10, 20 or 30 years, and pays your beneficiaries if you were to pass away throughout that term. A gives protection for your entire life period and pays out when you pass away.

One usual general rule is to go for a life insurance policy plan that will pay as much as 10 times the insurance policy holder's salary quantity. Additionally, you could select to utilize something like the cent technique, which includes a household's debt, earnings, mortgage and education and learning costs to calculate just how much life insurance policy is required.

It's additionally worth keeping in mind that there are age-related limits and limits enforced by virtually all insurance companies, that typically will not provide older purchasers as lots of alternatives, will charge them much more or may deny them outright. job loss mortgage insurance quotes.

Homeowner Mortgage Insurance

Right here's just how home mortgage protection insurance coverage determines up against standard life insurance coverage. If you're able to qualify for term life insurance, you need to prevent home mortgage defense insurance policy (MPI). Contrasted to MPI, life insurance policy provides your family members a less costly and much more versatile advantage that you can count on. It'll pay out the very same amount anytime in the term a death takes place, and the cash can be used to cover any type of expenditures your household regards essential at that time.

In those circumstances, MPI can provide wonderful comfort. Simply be sure to comparison-shop and check out every one of the fine print prior to signing up for any kind of plan. Every home mortgage defense choice will certainly have various regulations, laws, advantage choices and disadvantages that require to be evaluated thoroughly against your exact circumstance.

A life insurance policy plan can assist settle your home's mortgage if you were to die. It's one of lots of manner ins which life insurance policy might help safeguard your loved ones and their financial future. Among the very best ways to factor your mortgage right into your life insurance policy demand is to talk with your insurance agent.

Instead of a one-size-fits-all life insurance policy policy, American Family Life Insurance policy Firm uses policies that can be made especially to meet your family's demands. Here are a few of your alternatives: A term life insurance policy policy (chase mortgage life insurance) is energetic for a details quantity of time and typically supplies a bigger amount of insurance coverage at a reduced cost than an irreversible policy

Rather than only covering an established number of years, it can cover you for your whole life. It also has living benefits, such as cash worth build-up. * American Family Life Insurance Company provides different life insurance policy plans.

Your representative is an excellent resource to address your questions. They may additionally have the ability to help you locate spaces in your life insurance policy coverage or new ways to conserve on your other insurance plan. ***Yes. A life insurance coverage recipient can pick to make use of the survivor benefit for anything. It's an excellent method to assist secure the financial future of your household if you were to pass away.

Instant Mortgage Insurance Quotes

Life insurance is one means of helping your family in paying off a home loan if you were to pass away prior to the home loan is entirely repaid. Life insurance earnings might be used to aid pay off a home mortgage, but it is not the same as mortgage insurance policy that you could be called for to have as a problem of a funding.

Life insurance may aid ensure your residence remains in your family members by giving a survivor benefit that might assist pay down a home loan or make vital acquisitions if you were to die. Get in touch with your American Family members Insurance policy representative to go over which life insurance coverage policy best fits your demands. This is a brief description of insurance coverage and goes through plan and/or rider terms, which may vary by state.

Do You Have To Have Life Insurance To Get A Mortgage

The words lifetime, long-lasting and long-term are subject to plan terms and conditions. * Any type of car loans taken from your life insurance policy policy will certainly accumulate interest. Any kind of impressive finance balance (financing plus interest) will be subtracted from the survivor benefit at the time of case or from the money worth at the time of surrender.

Price cuts do not use to the life policy. Policy Kinds: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22 - mortgage protection insurance usa.

Mortgage security insurance coverage (MPI) is a various type of safeguard that might be useful if you're unable to settle your mortgage. Mortgage security insurance coverage is an insurance policy that pays off the rest of your home loan if you pass away or if you become impaired and can't work.

Both PMI and MIP are called for insurance policy protections. The quantity you'll pay for mortgage defense insurance coverage depends on a range of variables, consisting of the insurance firm and the present balance of your mortgage. when is mortgage insurance needed.

Still, there are pros and cons: The majority of MPI policies are provided on a "guaranteed approval" basis. That can be useful if you have a wellness problem and pay high prices permanently insurance policy or battle to get protection. An MPI plan can provide you and your household with a complacency.

Best Home Buyers Protection Insurance

You can select whether you require home mortgage protection insurance policy and for just how lengthy you require it. You might desire your home mortgage protection insurance policy term to be close in length to just how long you have actually left to pay off your home loan You can cancel a home mortgage defense insurance plan.

Latest Posts

Instant Insurance Life Smoker

Final Care

Universal Life Insurance And Instant Quote