Featured

Table of Contents

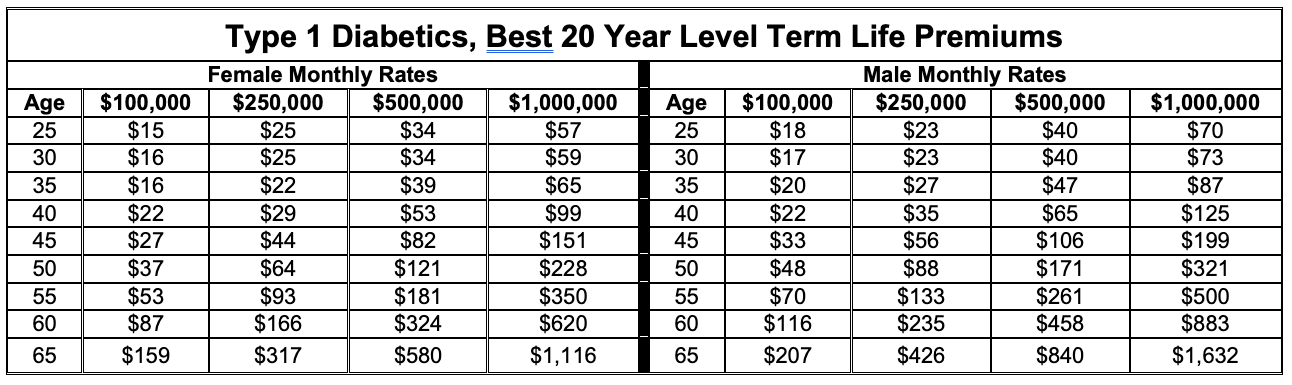

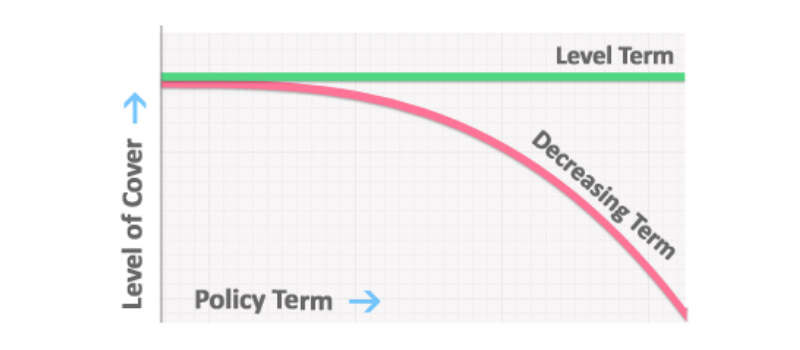

A level term life insurance policy policy can give you assurance that individuals that depend upon you will have a survivor benefit during the years that you are intending to support them. It's a way to assist look after them in the future, today. A level term life insurance policy (sometimes called level costs term life insurance coverage) policy provides coverage for an established variety of years (e.g., 10 or twenty years) while maintaining the costs settlements the exact same for the period of the policy.

With level term insurance coverage, the expense of the insurance will stay the exact same (or potentially lower if returns are paid) over the regard to your plan, usually 10 or 20 years. Unlike irreversible life insurance coverage, which never ever expires as long as you pay costs, a level term life insurance policy policy will end eventually in the future, commonly at the end of the period of your level term.

What is What Does Level Term Life Insurance Mean? Pros, Cons, and Considerations?

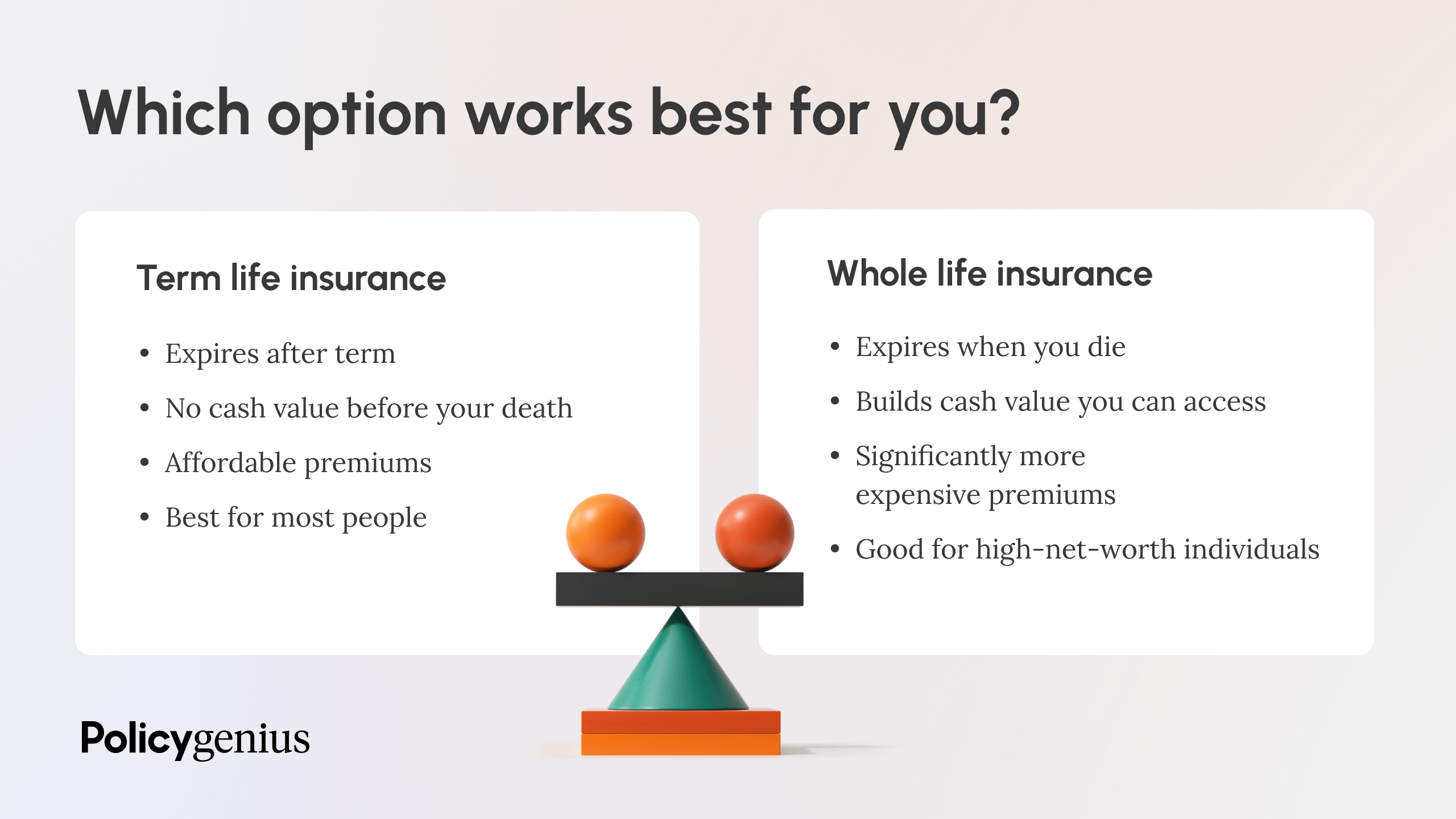

Due to this, several individuals use irreversible insurance policy as a secure monetary planning tool that can serve numerous requirements. You may be able to transform some, or all, of your term insurance throughout a set period, generally the first 10 years of your policy, without needing to re-qualify for insurance coverage even if your health has altered.

As it does, you may intend to add to your insurance protection in the future. When you first obtain insurance policy, you might have little savings and a big home mortgage. At some point, your financial savings will certainly grow and your mortgage will shrink. As this takes place, you may intend to eventually lower your death benefit or take into consideration transforming your term insurance to a permanent plan.

As long as you pay your premiums, you can relax easy recognizing that your loved ones will receive a survivor benefit if you die throughout the term. Numerous term plans enable you the capacity to convert to permanent insurance policy without needing to take one more wellness exam. This can permit you to make the most of the additional benefits of a long-term plan.

Level term life insurance policy is among the most convenient paths right into life insurance policy, we'll go over the benefits and disadvantages to ensure that you can select a plan to fit your requirements. Level term life insurance is the most common and fundamental kind of term life. When you're searching for temporary life insurance policy plans, level term life insurance policy is one route that you can go.

The application process for degree term life insurance policy is normally extremely straightforward. You'll load out an application which contains general individual info such as your name, age, and so on as well as an extra thorough survey regarding your medical history. Relying on the policy you have an interest in, you might need to join a medical exam process.

The short solution is no. A level term life insurance policy policy doesn't build money worth. If you're wanting to have a plan that you're able to take out or borrow from, you may explore permanent life insurance. Entire life insurance coverage plans, as an example, allow you have the comfort of survivor benefit and can accrue cash money value with time, suggesting you'll have a lot more control over your advantages while you're active.

What Does Voluntary Term Life Insurance Provide?

Cyclists are optional arrangements included to your plan that can give you fringe benefits and protections. Motorcyclists are a wonderful means to add safeguards to your plan. Anything can occur over the program of your life insurance policy term, and you wish to be ready for anything. By paying simply a bit much more a month, riders can provide the support you need in instance of an emergency situation.

There are circumstances where these advantages are built right into your plan, yet they can additionally be readily available as a separate addition that requires extra payment.

Latest Posts

Instant Insurance Life Smoker

Final Care

Universal Life Insurance And Instant Quote